Energy Star Air Conditioner Tax Credit

Uniform Energy Factor UEF 082. 112018 through 12.

Appliance Rebates Cape Light Compact

Not all ENERGY STAR products will qualify for the tax credit.

Energy star air conditioner tax credit. If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal residence and is placed in service between January 1 2021 and December 31 2021 then the homeowner may qualify for a non-refundable tax credit under Section 25C of the IRC for expenditures made for the advanced main air. The tax credit program covers a lot of different systems and energy efficient products. For more information on federal energy tax credits visit Energystargov.

Up to 350 for an ENERGY STAR air conditioner Solar. Split Systems must have an HSPF Heating Seasonal Performance Factor of at least 85 an EER Energy Efficiency Ratio of at least 125 and a SEER Seasonal Energy Efficiency Ratio of at least 15. Residential Electric Heat Pump Water Heater.

Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. The Bipartisan Budget Act passed in 2017 was an extension of tax credits for energy-efficient upgrades to your home. To verify tax credit eligibility ask your HVAC contractor to provide the Manufacturer Certification Statement for the equipment you plan to purchase.

Heat Pumps Meeting the Following Requirements are Eligible for a 300 Tax Credit. View ENERGY STAR criteria. In the Im looking for.

Gas propane or oil boilers Gas powered boilers. Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. Oil Furnace AFUE 90 30 of cost up to 15002 Gas Propane or Oil Hot Water Boiler AFUE 90 30 of cost up to 15002 Advanced Main Air Circulating Fan No more than 2 of furnace total energy use 30 of cost up to 15002 Water Heaters Gas Oil.

For example certain products such as Energy Star rated windows doors and skylights insulation and metal or asphalt roofs get a percentage of costs. 300 Requirements Split Systems. Consumer Energy Efficiency Definitions ENERGY STAR distinguishes energy efficient products which although they may cost more to purchase than standard models will pay you back in lower energy bills within a reasonable amount of time without a tax credit.

Central air conditioning Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for a 300 tax credit. Air conditioners with the designation of ENERGY STAR Most Efficient meet the tax credit requirements. Click Tax Tools lower left side of your screen.

SEER 16 EER 13 Package systems. 1332 Views Sep 15 2020 Knowledge Can I use the 1040EZ or 1040A form and get the tax credit for energy efficiency. Unfortunately tax credits are not available for new constructions or rentals so its only for systems that you replaced or added at your current home.

Advanced Main Air Circulating Fan. Also if youve already claimed 500 from the Non-business Energy Property Tax Credit since 2005 you wont be eligible to claim any more credits. Heat Pumps 300 Tax Credit Central Air Conditioning 300 Tax Credit Hot Water Boilers 150 Tax Credit Furnaces and Fans 150 Tax Credit Water Heaters 300 Tax Credit As a rule of thumb any item you purchase must be Energy Star-certified.

Residential Water Heaters or Commercial Water Heaters and select Yes for Tax Credit Eligible under Advanced Search. Be sure to click the Learn more links if you have any questions. 100 per watt maximum of 6000 when you install a solar PV system British Columbia Rebates.

The Non-Business Energy Property Tax Credits have been retroactively extended. ENERGY STAR Products That Qualify for Federal Tax Credits. For full details see the Energy Star website.

So making smart decisions about your homes heating ventilating and air conditioning HVAC system can have a big effect on your utility bills and your comfort. Heating Ventilation and Air Conditioning Some heating ventilation and air-conditioning equipment qualifies for an energy tax credit. Each model must be Energy Star-certified.

Based on the type and the amount your tax credit may vary. SEER 14 EER 12 See definitions More Information. Split system air conditioning - must meet 25C requirements of 16 SEER13 EER both efficiency levels must be met to qualify for the tax credit Manufacturers Certificate.

Follow the onscreen instructions to complete this section. Energy-efficient heating and air conditioning systems Water heaters natural gas propane or oil Biomass stoves qualified biomass fuel property expenditures paid or incurred in taxable years beginning after December 31 2020 are now part of the residential energy efficient property credit for alternative energy equipment. In the results box highlight 5695 residential energy credit then click GO.

Federal Tax Credits. You can claim the following items on your taxes using IRS Form 5695. While ENERGY STAR supplies some information about tax credits here the tax credits are administered by the IRSYou will have to claim the credit using the form below and submitting it with your tax returns to the IRS.

In the pop-up window select Topic Search. The tax credit is for 300. Consumer Energy Efficiency Definitions Federal Tax Credits.

Does the tax credit double for married people filing a joint tax return. AC Unit and Heating Units 300 tax credit for Energy Star approved units. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling.

The tax credit is for 300. Home About ENERGY STAR Federal Tax Credits Federal Tax Credits. If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal residence and is placed in service between January 1 2021 and December 31 2021 then the homeowner may qualify for a non-refundable tax credit under Section 25C of the IRC for expenditures made for the advanced main air.

The following Trane residential products qualify for a federal tax credit. Air-source heat pumps Heat pumps that are ENERGY STAR certified qualify for a 300 tax credit. How to apply.

Uniform Energy Factor UEF 22.

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Ge Energy Star 8 000 Btu 115 Volt Smart Electronic Window Air Conditioner Aklk08aa Ge Appliances

Ge 250 Sq Ft Window Air Conditioner 115 Volt 6150 Btu Energy Star In The Window Air Conditioners Department At Lowes Com

Energy Star Certified Room Air Conditioners Epa Energy Star

Ge 1500 Sq Window Air Conditioner 230 Volt 24000 Btu Energy Star In The Window Air Conditioners Department At Lowes Com

Lg Electronics 8 000 Btu 115 Volt Window Air Conditioner Lw8016er With Energy Star And Remote In White Lw8016er The Home Depot

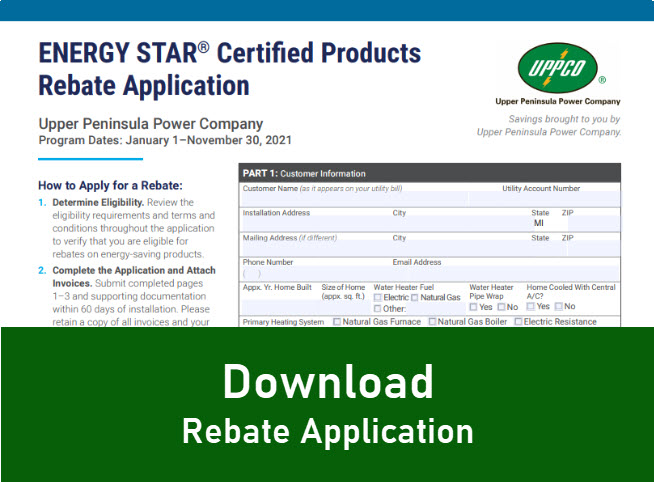

Energy Efficiency Rebates Uppco

Ge 1500 Sq Window Air Conditioner 230 Volt 24000 Btu Energy Star In The Window Air Conditioners Department At Lowes Com

Federal Tax Credits For Heating Ventilating And Air Conditioning Hvac Energy Star

Energy Star Most Efficient 2021 Furnaces Products Energy Star

Ge 1500 Sq Ft Window Air Conditioner 230 Volt 24000 Btu Energy Star At Lowes Com

Energy Star Certified Room Air Conditioners Epa Energy Star

Federal Tax Credits For Heating Ventilating And Air Conditioning Hvac Energy Star

Home Energy Rebates Save Money With Oklahoma Home Rebates Power Forward With Pso

Trane Xr16 Air Conditioner Best Rebate Prices Now

Ge Energy Star 8 000 Btu 115 Volt Smart Electronic Window Air Conditioner Aklk08aa Ge Appliances

Ge 450 Sq Ft Window Air Conditioner 115 Volt 10000 Btu Energy Star In The Window Air Conditioners Department At Lowes Com

Posting Komentar untuk "Energy Star Air Conditioner Tax Credit"